United StatesUNITED STATES

Securities and Exchange CommissionSECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

ScheduleSCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |   | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material |

Louisiana-Pacific Corporation

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee | |

| No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table |

|

| |

|

| PROXY STATEMENT AND NOTICE TO STOCKHOLDERS OF ANNUAL MEETING |

LP is a trademark of |

W. BRADLEY SOUTHERN

DIRECTOR & CHIEFEXECUTIVE OFFICER

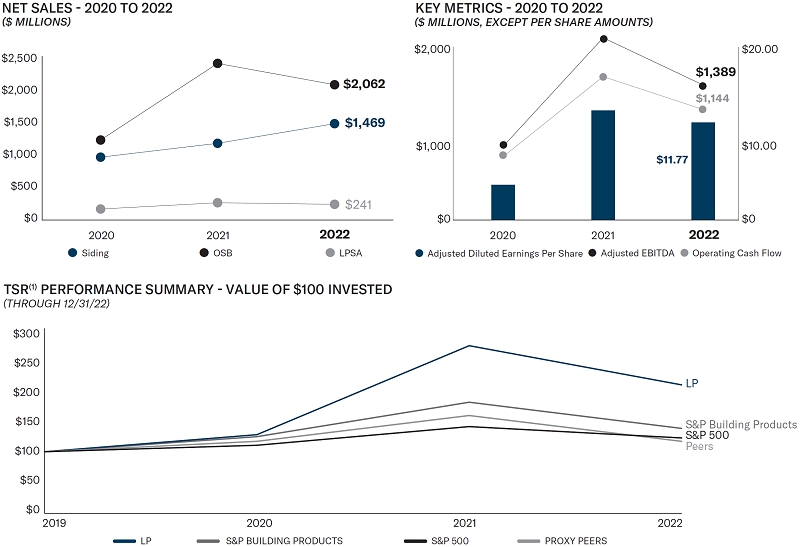

+10%

SMARTSIDE STRANDREVENUE GROWTH IN AFLAT HOUSING MARKET

PositiveOSB EBITDA

AT THE BOTTOM OFTHE OSB PRICE CYCLE

$159MILLION

CASH FLOW FROM

OPERATIONS

“On behalf of our Board of Directors, I thank you for your continued confidence and support of the work we do every day.”

Dear Stockholder:

On behalf of the Board of Directors of Louisiana-Pacific Corporation (“LP”), thank you for your investment and continued confidence in LP. I cordially invite you to attend our Annual Meeting of Stockholders. The meeting will be held on May 22, 2020, at 7:30 a.m., Central time, at LP’s Corporate Headquarters, 414 Union Street, Suite 2000, Nashville, Tennessee 37219.*

W. BRADLEY SOUTHERN +26% SIDING $1.0B RETURNED TO STOCKHOLDERS* | “In our 50th anniversary year, LP’s teams delivered new records for Siding and Structural Solutions.” Dear Stockholder: On behalf of the Board of Directors of Louisiana-Pacific Corporation (“LP”), thank you for your investment and continued confidence in LP. I cordially invite you to attend our 2023 Annual Meeting of Stockholders. This year’s Annual Meeting of Stockholders will be held virtually via live audio webcast at http://www.virtualshareholdermeeting.com/LPX2023 on April 28, 2023 at 7:30 a.m. Central Time.

At this year’s meeting, you will be asked to vote on (1) the election of two Class II directors, (2) the ratification of the appointment of

NOTICE of Annual Meeting of Stockholders

WHO MAY VOTE:

Only stockholders of record at the close of business on March

ADMISSION:

LOUISIANA-PACIFIC CORPORATION • Important Notice Regarding the Availability of Proxy Materials for the | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Our 2023 Annual Meeting of Stockholders will be held virtually via live audio webcast at http://www.virtualshareholdermeeting.com/LPX2023 on Friday, April 28, 2023, at 7:30 a.m. Central Time. At the time this proxy statement was printed, management knew of only the following four items of business to be presented at the 2023 Annual Meeting of Stockholders, as listed in the Notice of Annual Meeting of Stockholders and the Notice of Internet Availability of Proxy Materials (further described under “Voting Procedure” below).

The LP Board recommends a vote “FOR” the election of two Class II Directordirector nominees, Mr. LandgrafJose A. Bayardo and Mr.Stephen E. Macadam, both of whom are current members of the Board. Mr. Landgraf is an independent director and serves as the Chairman of the Finance and Audit Committee (“Audit Committee”) and as a member of the Executive Committee and the Compensation Committee. Mr. MacadamBayardo is an independent director and serves as a member of the Finance and Audit Committee of the Board (“Audit Committee”) and Environmental, Qualitythe Governance and ComplianceCorporate Responsibility Committee of the Board (“EQCGovernance Committee”). Mr. Macadam is an independent director and serves as Chair of the Compensation Committee of the Board, and as a member of the Audit Committee, the Executive Committee and the Governance Committee. Additional biographical information regarding each nominee may be found below under “Director Nominees.“Proposal 1: Election of Directors—Nominees for Director.”

The LP Board recommends a vote “FOR” the ratification of the appointment of Deloitte & Touche LLP as LP’s independent registered public accounting firm for 2020.2023. Additional information regarding the independent registered public accounting firm may be found below under “Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm for 2020.Firm.”

The LP Board recommends a vote for “1 YEAR” on the frequency of the advisory votes on named executive officer compensation. The Dodd-Frank Wall Street Reform and Consumer Protection Act requires that we provide our stockholders an opportunity to cast a non-binding, advisory vote on the frequency of advisory votes on named executive officer compensation at least once every six years. Stockholders may indicate whether they would prefer to hold this advisory vote once every one, two or three years. The Board believes an advisory vote on named executive officer compensation that occurs every year is the most appropriate alternative for our company because it provides us with immediate and direct input on our compensation philosophy, policies and practices. We value the opinions of our stockholders and will consider the option that receives the most votes in deciding how often to hold the advisory vote on named executive officer compensation in future years.

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 5

The LP Board recommends a vote “FOR” the approval, on a non-binding, advisory basis, of 2019the compensation of LP’s named executive officer compensation. Weofficers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC, including the “Compensation of Executive Officers—Compensation Discussion and Analysis” section, the “Summary Compensation Table”, the other executive compensation tables and accompanying footnotes and narrative discussion. The Dodd-Frank Wall Street Reform and Consumer Protection Act requires that we provide our stockholders an opportunity to cast a non-binding, advisory vote on the compensation of our named executive officers. We believe that our executive compensation programs must attract, retain and motivate our management team to lead our company to sustainable financial performance that furthers the long-term interests of LP and its stockholders.stakeholders. Stockholders approved the 2018 named executive officer compensation described in our 2022 Proxy Statement at the 20192022 Annual Meeting of Stockholders meeting by a favorable vote of 91 percentapproximately 97% of the votes cast. Additional information regarding executive compensation may be found below under “Compensation of Executive Officers.”

LOUISIANA-PACIFIC CORPORATION•2020 2023 PROXY STATEMENT 6

|

As allowed by rules and regulations of the SEC, we are providing access to this proxy statement by internet.Internet. You will not receive a paper copy of this proxy statement by mail unless you request it. Instead, you were sent a Notice of Internet Availability of Proxy Materials providing instructions on how to view this proxy statement and vote your proxy by internet.Internet.

If you requested a paper copy of this proxy statement, a proxy card is enclosed for your use. To vote by mail, please sign, date, and return the proxy card promptly. For your convenience, a return envelope is enclosed, which requires no postage if mailed in the United States. You may indicate your voting instructions on the proxy card in the spaces provided. Properly completed proxies will be voted as instructed. If you return a proxy without indicating voting instructions, your shares will be voted in accordance with the recommendations of the Board for the directors nominated in ItemProposal 1, “FOR” Proposal 2 and Proposal 4, and for Item 2 and Item“1 YEAR” in Proposal 3 listed in the Notice of Internet AvailabilityAnnual Meeting of Proxy Materials.Stockholders. If you hold your shares in an account with a bank, broker or other financial institution (i.e., in “street name”), you can vote by following the instructions on the voting instruction form provided to you by your bank, broker or other financial institution.

If you vote your proxy prior to the meeting, you may revoke it by (1) by filing either a written notice of revocation or a properly signed proxy bearing a later date with the Corporate Secretary of LP at any time before the meeting, or if you hold your shares in “street name,” following the instructions on your voting instruction form, (2) submitting a subsequent proxy via the Internet or by telephone, (3) submitting another properly signed proxy card (or voting in person atinstruction form) bearing a later date, or (4) voting electronically during the 20202023 Annual Meeting of Stockholders or (3) by followingwhile logged in using the instructions in the16-digit voting control number found on your proxy card, Notice of Internet Availability of Proxy Materials.Materials or voting instruction form.

If shares are held for your account in the AutomaticLP’s Direct Stock Purchase and Dividend Reinvestment Plan administered by Computershare Trust Company, N.A., all your shares held in the plan will be voted in the same manner as shares you vote by proxy. If you do not vote by proxy, the shares held for your account in the plan will not be voted.

Only stockholders of record at the close of business on March 26, 2020,1, 2023, are entitled to receive notice of the 20202023 Annual Meeting of Stockholders and to vote at the 20202023 Annual Meeting of Stockholders. At the record date, there were 112,169,09972,019,778 shares of common stock of LP, $1 par value per share (“Common Stock”), outstanding. Each share of Common Stock is entitled to one vote on each matter to be acted upon.upon at the meeting. A majority of the outstanding shares of Common Stock represented at the meeting will constitute a quorum. Additional information concerning holders of outstanding Common Stock may be found under the heading “Holders of Common Stock” below.

The Board has adopted a confidential voting policy which provides that the voting instructions of stockholders are not to be disclosed to LP except (a) in the case of communications intended for management, (b) in the event of certain contested matters or (c) as required by law. Votes will be tabulated by independent tabulators and summaries of the tabulation will be provided to management.

If your shares are held in “street name” (meaning in the name of your bank, broker or other financial institution) and you were a beneficial owner of shares of Common Stock at the close of business on the record date, you have the right to direct your bank, broker or other financial institution how to vote your shares by following the voting instructions your bank, broker or other financial institution provides. If you do not provide your bank, broker or other financial institution with instructions on how to vote your shares, your bank, broker or other financial institution will only be permitted to vote your shares with respect to some of the proposals, but not all. Banks, brokers and brokersother financial institutions acting as nominees for beneficial owners are not permitted to vote proxies with regard to ItemsProposals 1, 3 and 34 on behalf of beneficial owners who have not provided voting instructions to the nominee (a “broker non-vote”), making it especially important that, if you hold your shares in “street name,” you send your bank, broker or other financial institution your voting instructions.

LOUISIANA-PACIFIC CORPORATION•2020 2023 PROXY STATEMENT 7

| PROPOSAL 1ELECTION OF DIRECTORS |

We have a professionally diverse and independent Board. The Board currently has nineeight members, consisting of our CEOChief Executive Officer and eightseven independent directors. LP’s Amended and Restated Bylaws (the “Bylaws”) provide for a classified Board consisting of three classes. The termclasses, with each class serving three-year terms. If elected at the 2023 Annual Meeting of Stockholders, the terms of our Class II directors will expire at the 20202026 Annual Meeting; the termMeeting of Stockholders. The terms of our Class III directors will expire at the 2021 annual meeting2024 Annual Meeting of stockholders;Stockholders and the termterms of our Class I directors will expire at the 2022 annual meeting2025 Annual Meeting of stockholders.Stockholders.

Stockholders are being asked to vote on the election of two Class II directors, Mr. LandgrafJose A. Bayardo and Mr.Stephen E. Macadam, to serve until the 2023 annual meeting2026 Annual Meeting of stockholdersStockholders and until their successors are duly elected and qualified. Mr. Cook, whoEach of these director nominees currently serves as Chairman of the Board, will not be standing for re-election at the 2020 Annual Meeting, and therefore, the size of the Board will be reduced from nine to eight members at the 2020 Annual Meeting.

a Class II director. The Board has determined that each of Mr. LandgrafBayardo and Mr. Macadam (i) has no material relationship with LP (either directly or as a partner, stockholder, officer or director of an organization that has a relationship with LP) other than his service as a director of LP, and (ii) is independent under the listing standards adopted by the New York Stock Exchange (the “NYSE”).

—MAJORITY VOTE STANDARD FOR ELECTION OF DIRECTORS

Your shares represented by a properly completed and returned proxy card will be voted “FOR” the election of the two nominees named above unless you specify otherwise (Item 1 on the proxy card)(Proposal 1). If any nominee becomes unavailable to serve, your proxy will be voted for a substitute nominee designated by the Board, or the Board may decrease the size of the Board. Each nominee who receives the affirmative vote of a majority of the total votes cast on theirhis election will be elected, meaning that a nominee will be elected if the number of shares voted for a director’sthat nominee’s election exceeds the number of votes cast against that director’snominee’s election. Shares not voted on the election of a nominee, whether because of an abstention, the record holder fails to return a proxy, or aAbstentions and broker non-vote occurs,non-votes will not count in determining the total number of votes cast on their election.

Set forth below is certain information about the background, skills and expertise of each director nominated for election relevant to theirhis service as a director, as well as certain information about the background, skills and expertise of the other members of the Board whose terms of office will continue beyond the 20202023 Annual Meeting of Stockholders. The summary of qualifications that the Nominating and Governance Committee (“Governance Committee”) uses in its review of director qualificationsnominees is described below under “Corporate Governance – Governance—Consideration of Director Nominees” following the individual director biographical information below.Nominees.”

| THE NOMINEES HAVE BEEN RECOMMENDED TO THE BOARD BY THE GOVERNANCE COMMITTEE OF THE BOARD. THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE TWO NOMINEES IDENTIFIED BELOW. |

LOUISIANA-PACIFIC CORPORATION•2020 2023 PROXY STATEMENT 8

Age

Director since:

INDEPENDENT | ||

JOSE A. BAYARDO

Background: Mr. Bayardo is the Senior Vice President and Chief Financial Officer of NOV Inc. (NYSE:

Skills and Expertise:The Board selected Mr.

Committees:Audit Committee, | ||

Age

Director since:

INDEPENDENT

| |

STEPHEN E. MACADAM | |

Retired Chief Executive Officer of EnPro Industries, Inc. Background:Mr. Macadam served as Chief Executive Officer and President of EnPro Industries, Inc. (NYSE: NPO), a manufacturing company (“Enpro”), from April 2008

Skills and Expertise:The Board selected Mr. Macadam

Committees:Audit Committee, |

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 9

The current members of the Board whose terms of office will continue beyond the 20202023 Annual Meeting of Stockholders are listed below. The Board has determined that each continuing director named below, other than Mr. Southern, (i) has no material relationship with LP (either directly or as a partner, stockholder, officer or director of an organization that has a relationship with LP) other than his or her service as a director of LP, and (ii) is independent under the listing standards adopted by the NYSE.

Age

Director since:

INDEPENDENT

| ||

TRACY A. EMBREE

Vice President and President of Distribution Business Segment of Cummins, Inc. Background:Ms. Embree has worked at Cummins Inc. (NYSE: CMI), a leader in the design, manufacture, distribution and service of diesel and alternative fuel engines and related technologies (“Cummins”), since 2000 and

Skills and Expertise:The Board selected Ms. Embree to serve as a director based upon

Committees: | ||

Age

Director since: 2006 –

INDEPENDENT | |

LIZANNE C. GOTTUNG | |

Retired EVP-Senior Adviser to the CEO/Chairman of Kimberly-Clark Corporation Background:Ms. Gottung joined the board of directors of Sylvamo Corporation (NYSE: SLVM), a global producer of uncoated paper, in October 2021 and serves as the Chair of the Management Development and Compensation Committee. Ms. Gottung retired from Kimberly-Clark Corporation (NYSE: KMB) in 2017 as EVP-Senior Adviser to the CEO/Chairman of Kimberly-Clark Corporation. Prior to that appointment, Ms. Gottung served as Senior Vice President and Chief Human Resources Officer of Kimberly-Clark Corporation from

Skills and Expertise:The Board selected Ms. Gottung to serve as a director based upon

Committees: |

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 10

Age

Director since:

INDEPENDENT

| ||

F. NICHOLAS GRASBERGER III | ||

Chairman and Chief Executive Officer of Harsco Corporation Background:Mr. Grasberger is Chairman and Chief Executive Officer of Harsco Corporation (NYSE: HSC), a global market leader providing environmental solutions for industrial and specialty waste streams and innovative technologies for the rail

Skills and Expertise:The Board selected Mr. Grasberger to serve as a director based upon his broad financial expertise and strong leadership experience. The Board believes that Mr. Grasberger’s significant record as a successful

Committees:Audit Committee | ||

Age

Director since:

INDEPENDENT

| |

OZEY K. HORTON, JR. | |

Director Emeritus of McKinsey & Company Background:Mr. Horton has been a Director Emeritus of McKinsey & Company, a global management and consulting firm, since 2011, when he retired after nearly 30 years with the firm. At McKinsey & Company, Mr. Horton worked in various practice areas around the globe, including Pulp, Paper and Packaging, Industrial, Change Management, Global Operations in Energy and Materials, and Basic Materials. Mr. Horton is a faculty member for McKinsey & Company’s leadership development program and also serves as an independent business advisor. Mr. Horton also serves as a director of Worthington Industries, Inc. (NYSE: WOR). Mr. Horton graduated from Duke University with a bachelor of science degree in

Skills and Expertise:The Board selected Mr. Horton to serve as a director because of his extensive experience in global operations, strategic planning, merger and acquisition integration and change management. The Board believes that Mr. Horton’s broad understanding of the operational and strategic issues facing large global companies and his experience in both change management and merger and acquisition integration make him particularly well-suited to serve as a director of LP.

Committees: |

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 11

Age

Director since:

LEAD

| ||

DUSTAN E. MCCOY | ||

Retired Chairman and Chief Executive Officer of Brunswick Corporation Background:Mr. McCoy was Chairman and Chief Executive Officer and a director of Brunswick Corporation (NYSE: BC), a market leader in the marine, fitness and billiards industries, from December 2005 until his retirement

Skills and Expertise:The Board selected Mr. McCoy to serve as a director because of his extensive experience in legal and compliance matters, and specifically his experience in corporate governance and disclosure matters for publicly traded companies. The Board believes that Mr. McCoy’s broad understanding of the operational, financial and strategic issues facing large global companies, his leadership and oversight in LP’s compliance matters, his leadership roles for companies producing both commodity and specialty products, and his valuable strategic advice to the Board and management in advancing LP’s interests make him particularly well-suited to serve as a director of LP.

Committees:Compensation Committee, | ||

Age

Director since:

| |

W. BRADLEY SOUTHERN | |

Chairperson of the Board and Chief Executive Officer of LP Background:Mr. Southern has been Chairperson of the Board since May 2020 and Chief Executive Officer of LP since July

Skills and Expertise:The Board selected Mr. Southern to serve as a director based upon

Committees:Executive Committee |

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 12

|

|

Set forth below is

The following matrix provides information aboutregarding the members of our director whoBoard, including demographic information for, and certain qualifications and experience possessed by, the members of our Board, which our Board believes are relevant to our business and industry and provide a range of viewpoints that are invaluable for our Board’s discussions and decision-making processes. The matrix does not encompass all of the qualifications, experiences or attributes of the members of our Board, and the fact that a particular qualification, experience or attribute is not standing for re-election atlisted does not mean that a director does not possess it. In addition, the 2020 Annual Meeting.absence of a particular qualification, experience or attribute with respect to any of the members of our Board does not mean the director in question is unable to contribute to the decision-making process in that area. The type and degree of qualification and experience listed below may vary among the members of the Board.

| ||

|

| Qualifications and Experience | Bayardo | Embree | Gottung | Grasberger | Horton | Macadam | McCoy | Southern |

| Public Company Board Experience |  |  |  |  |  |  |  | |

| C-Suite Leadership |  |  |  |  |  |  | ||

| Financial Literacy / Accounting |  |  |  |  | ||||

| Manufacturing and Distribution / Sourcing / Logistics |  |  |  |  |  |  | ||

| Global Operations Experience |  |  |  |  |  |  |  |  |

| HR / Labor Relations |  | |||||||

| Sales / Marketing |  |  |  |  | ||||

| Risk Management |  |  |  |  |  |  |  |  |

| Strategic Planning |  |  |  |  |  |  |  |  |

| Corporate Governance / Ethics / Legal |  |  | ||||||

| Environmental / Sustainability / Corporate Responsibility |  |  |  |  |  | |||

| Demographics | ||||||||

| Race / Ethnicity | ||||||||

| African American | ||||||||

| Asian / Pacific Islander | ||||||||

| White / Caucasian |  |  |  |  |  |  |  |  |

| Hispanic / Latino |  | |||||||

| Native American | ||||||||

| Gender | ||||||||

| Male |  |  |  |  |  |  | ||

| Female |  |  | ||||||

| Non-Binary | ||||||||

| LGBTQ+ | ||||||||

| Board Tenure | ||||||||

| Years of Service | 1 | 7 | 17 | 4 | 7 | 4 | 21 | 6 |

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 13

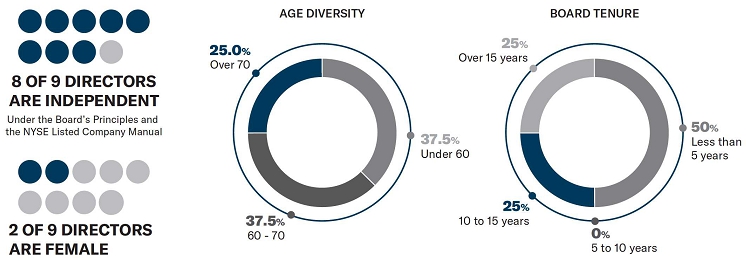

Current Board Composition

Principles of Corporate Governance

Strong corporate leadership of the highest ethics and integrity has long been a major focus of LP’s Board and management. The key tenets of LP’s Corporate Governance PrinciplesGuidelines include the following:

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 14

| — | meet the applicable standards imposed by the SEC and the | |

| be independent of management and LP and free of any relationship that, | ||

| have not been an officer or employee of LP (including its subsidiaries or affiliates) at any time in the past three years and in order to qualify for service on the Compensation Committee, have not been an officer or employee of LP (including its subsidiaries or affiliates) at any time in the past five years; and | ||

| have no material relationship with LP or any of its affiliates or any executive officer of LP or any of its affiliates (either directly or as a partner, shareholder or officer of an |

| • | The Board has determined that each current director other than Mr. Southern is independent under the standards listed above. LP’s independence standards are available on its website at www.lpcorp.com by clicking on “About LP,” then “Financial Info,” then “Investor Relations,” then “Corporate Governance,” together with the rest of LP’s Corporate Governance | |

| • | The independent directors meet in executive session without management present in connection with each quarterly Board meeting. | |

| • | Following any material change in his or her principal occupation or business association, including retirement from any such other occupation or association, that director must immediately tender his or her resignation for consideration by the Board, which may choose not to accept it. | |

| • | Directors must retire as of the date of the next annual meeting of stockholders after attaining age 75. | |

| • | Directors are provided with orientation and continuing education opportunities on an ongoing basis relating to performance of their duties as | |

| • | The composition, structure, purpose, responsibilities and duties of each of the standing Board committees | |

| • | The Board and each of the Board committees have authority to engage outside advisers, including an independent compensation consultant and outside legal counsel, who are independent of management to provide expert or legal advice to the directors. | |

| • | The Governance Committee oversees annual evaluations of the operations and effectiveness of the Board and | |

| • | Each director must receive a majority of the stockholder votes cast in uncontested elections of directors. | |

| • | LP has adopted both a Code of Business Conduct and Ethics and a Code of Ethics for senior financial officers. |

LOUISIANA-PACIFIC CORPORATION•2020 PROXY STATEMENT 14

| The Code of Business Conduct and Ethics is applicable to all directors, officers, and employees and addresses, among other matters, conflicts of interest, corporate opportunities, confidentiality, fair dealing, protection and proper use of company assets, legal and regulatory compliance, and reporting of illegal or unethical behavior. | ||

| The Code of Ethics for | ||

| Directors and executive officers may be granted waivers of either |

| • | LP’s CEO is responsible for maintaining a succession-planning process with respect to top management positions and must report to the Board at least annually regarding specific assessments and recommendations. | |

| • | The Board has adopted stock ownership guidelines for both directors and executive officers. The guidelines specify target amounts of share ownership. Each outside director is expected to acquire and hold a number of shares equal in value to five times the regular annual cash retainer for outside directors within five years of joining the Board. For |

Current copies of LP’s Corporate Governance Principles,Guidelines, Code of Business Conduct and Ethics, and Code of Ethics for Senior Financial Officerssenior financial officers are available on LP’s website at www.lpcorp.com by clicking on “About LP,” then “Financial Info,” then “Investor Relations,” then “Corporate Governance.” Any amendments to either codeCode will also be posted at www.lpcorp.com.www. lpcorp.com. Copies of any of these documents may also be obtained free of charge by writing to Corporate Affairs, Louisiana-Pacific Corporation, 414 Union Street,1610 West End Avenue, Suite 2000,200, Nashville, Tennessee 37219.37203.

ProhibitionLOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 15

The members of the Board have a diverse set of skills and experiences and all of the members, except our CEO, are independent. As discussed above, the CEO of LP currently serves as the Chairperson of the Board and the Board has elected Mr. McCoy to serve as our Lead Independent Director. We believe that our leadership structure is in the best interests of LP and its stockholders and that it fosters innovative, responsive and strong leadership for LP as a whole. Our Board has determined that the election of an executive Chairperson must be accompanied by the election of a Lead Independent Director with a clearly defined and dynamic leadership role in the governance of the Board. In May 2020, the Board determined that appointing Mr. Southern as Chairperson of the Board and Mr. McCoy as Lead Independent Director would result in the governance structure best suited to enable our Board and management to carry out their responsibilities to our stockholders and promote the growth of LP. We believe the structure promotes, through the clearly articulated roles and responsibilities of the Lead Independent Director and Board committees, the objective and effective oversight of management.

The Chairperson’s current Board duties include: calling meetings of the Board; taking primary responsibility for preparing agendas for Board meetings in consultation with the Lead Independent Director and other directors and management; chairing meetings of the Board and the annual meeting of stockholders; receiving feedback from executive sessions of the independent directors; chairing meetings of the Executive Committee; communicating with directors on Hedgingkey issues and concerns outside of Board meetings; and representing LP to, and interacting with, external stakeholders and LP employees.

The Lead Independent Director’s current duties include: participating in Board meetings; acting as an intermediary in the event the Chairperson refers to the Lead Independent Director for guidance or to have something taken up at executive session of the independent directors; suggesting calling Board meetings to the Chairperson when appropriate; calling meetings of the independent directors and setting the agenda for, and leading, executive sessions of the independent directors; briefing the Chairperson on issues arising in the executive sessions; collaborating with the Chairperson to set the Board agenda and providing the Board with information; facilitating discussion among the independent directors on key issues and concerns outside of Board meetings; serving as the exclusive conduit to the Chairperson of views, concerns and issues of the independent directors; retaining advisors and consultants at the request of independent directors; serving on the Executive Committee of the Board; and coordinating with the Compensation Committee in the performance and evaluation of the CEO.

The directors are elected representatives of the stockholders and act as fiduciaries on their behalf. In performing its general oversight function, the Board reviews and assesses LP’s strategic and business planning as well as management’s approach to addressing significant risks. All committees report directly to the Board regularly, and all committee minutes are distributed for review by the entire Board. Additionally, the Board and committees are authorized to retain independent advisers, including attorneys or other consultants, to assist in their oversight activities.

As set out in LP’s Corporate Governance Guidelines, it is the responsibility of the CEO, and of executive management under the CEO’s direction, to:

| • | operate and manage the business of LP on a day-to-day basis in a competent and ethical manner to produce value for the stockholders; |

| • | regularly inform the Board of the status of LP’s business operations; |

| • | engage in strategic planning; |

| • | prepare annual operating plans and budgets; and |

| • | oversee risk management and financial reporting. |

The Board fulfills its oversight responsibilities as set out in the Corporate Governance Guidelines on behalf of the stockholders and in furtherance of LP’s long-term health. The Board’s role does not involve managing the daily complexities of business transactions.

As part of its oversight responsibilities, the Board and its committees are involved in the oversight of risk management of LP. The current leadership structure provides directors with significant information related to risks faced by LP, as well as an opportunity to synthesize, discuss and consider these risks independent of management and to provide guidance to management. The Board oversees risk management in part through its review of findings and recommendations by LP’s Risk Management Council, the participants of which are executives and/or functional department leaders in the areas of risk management, finance, internal audit, legal and compliance, information technology (including cybersecurity), environmental, and product quality, all of whom supervise day-to-day risk management throughout LP. The purpose of the Risk Management Council is to help the CEO assess the effectiveness of LP’s identification and handling of risks. The Board and its committees have direct access to financial and compliance leaders on a quarterly basis or more frequently if requested. Further, the Board is provided a comprehensive report as to the Risk Management Council’s risk mapping efforts, as well as management’s efforts to mitigate and transfer risk.

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 16

The Board committees consider risks within their areas of responsibilities under each of their charters. The Audit Committee is responsible for the following risk oversight functions:

| • | overseeing LP’s enterprise risk management program, which includes consideration of operational risks, cyber-security risks, and financial risk related to accounting matters, financial reporting and legal and regulatory compliance; |

| • | reviewing various guidelines for cash, credit and liquidity measures; |

| • | reviewing risks related to financial disclosures and reporting; and |

| • | reviewing the audit risk assessment identifying internal controls and risks that affect the audit plan for the coming year. |

The Governance Committee is responsible for oversight of risk related to various regulatory changes and trends related to corporate governance, including Board member selection and maintaining appropriate corporate governance principles and guidelines, as well as overseeing annual evaluations to assess Board and committee effectiveness. Additionally, the Governance Committee is responsible for the responsibilities previously delegated to the Environmental Quality and Compliance Committee, including oversight of risk related to LP’s sustainability strategy, safety, environmental and product quality policies and practices, programs for ethics and business conduct, including various matters raised through LP’s anonymous hotline reporting service, legal compliance, political activities and advocacy and human resource practices.

The Compensation Committee is responsible for oversight of risk relating to employment policies and LP’s compensation and benefits systems, and annually reviewing these policies and practices to determine whether they are reasonably likely to have a material adverse effect on LP.

For more than half a century, we have worked to deliver on our purpose: Building a Better WorldTM. Our purpose guides all that we do, from the way we responsibly develop and manufacture products to the way we treat employees and give back to communities.

Our environmental, social and governance (ESG) program demonstrates our purpose at work and the continued evolution of our sustainability journey. Our sustainability program is centered on five pillars: governance, people, environment, products and community.

For additional information about our program, goals and metrics, read our 2022 Sustainability Report. The 2022 Sustainability Report is available on our website at www.lpcorp.com/sustainability. The 2022 Sustainability Report and other information contained on our website are not incorporated by reference herein.

Oversight for LP’s ESG program begins with the Governance Committee of the Board. The committee meets at least three times a year and oversees our sustainability strategy as well as our performance in relation to our goals. The committee also oversees the programs and processes related to management succession, safety, environmental and product quality, ethics and business conduct, political activities and human resources. Management oversees LP’s ESG program through LP’s ESG Executive Council, which is a cross-functional committee comprised of members of LP’s executive team, including the General Counsel, the Chief Financial Officer and the Senior Vice President of Manufacturing Services. The ESG Executive Council oversees the ESG Task Force, a group of subject matter experts responsible for developing and executing ESG strategies. The ESG Task Force is led by the General Counsel and includes the Vice President of Investor Relations and Business Development, the Director of Sustainability and Public Policy, the Director of Corporate Communications, the Director of Siding Business Growth and Optimization, and the Director of Internal Audit. The ESG Council meets quarterly with the ESG Task Force to discuss ESG strategies.

LP measures our progress in relation to our goals, as well as the programs, processes and initiatives we have in place across five critical areas: governance, people, environment, products and community. We evaluate risks and opportunities in each of these areas carefully. In 2021, we conducted an ESG priority assessment to ensure we incorporate the opinions of our employees, customers, investors and other stakeholders as we execute our sustainability strategy. The priority assessment revealed the most critical sustainability topics for LP based on six factors: meaningful impact on financial returns; reputational importance to LP; probability of negative outcome; LP’s ability to control, influence and mitigate; importance to stockholders and importance to non-owner stakeholders.

We provide ESG disclosures in line with the International Financial Reporting Standards Foundation’s Sustainability Accounting Standards Board (SASB) standards and the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. Our business is aligned with SASB’s Building Products and Furnishings and Forestry Management standards. Our TCFD index communicates how climate risks and opportunities are incorporated into our business strategy to facilitate long-term business resilience in light of climate change.

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 17

Our corporate governance practices and programs represent our commitment to ethical business. We work to create an environment within the workplace where all LP representatives—from directors to individual contributors—have a strong sense of accountability and integrity.

We have a diverse, independent Board that helps the company manage risk, as well as Board committees that oversee auditing, corporate responsibility, and executive compensation.

We expect all LP employees to act with the highest standards of ethics and integrity and carry our commitment to business ethics through to our suppliers. Our Code of Business Conduct and Ethics, Code of Ethics for Senior Financial Officers and Supplier Code of Conduct outline our standards and expectations. LP’s Human Rights Policy further details our expectations for working conditions and human rights in our operations.

At LP, people come first. We work to create an engaging and inclusive culture at LP that protects the health and well-being of our employees and creates opportunities for individuals to learn and grow while taking care of themselves and their families.

SAFETY

We are committed to creating a healthy, safe workplace for all employees. Our safety programs aim to prevent incidents before they occur. Applicable to all employees and contractors, our Environmental, Health and Safety (EHS) Protocol Standard defines our expectations for creating a safe work environment. Additionally, our recently introduced Serious Injury and Fatality (SIF) Prevention program uses predictive tools to further identify and target potential safety risks. Every LP employee or contractor receives baseline safety training when they join the company, plus supplemental training based on their job requirements. In addition to this baseline training, each facility provides extra training specific to safety considerations for the time of year, needs or high-risk activities. Since 2010, we have won 85 safety awards recognizing us for our performance and commitment to safety.

DIVERSITY, EQUITY AND INCLUSION

For LP, diversity, equity and inclusion (DEI) is a critical part of the way we do business. Our DEI Pledge for Action outlines our commitments and the actions we intend to take to help ensure our culture is one that promotes diversity, leads with inclusion and facilitates equity in our treatment of all employees.

Our DEI Goals

| • | Work to ensure our employee populations reflect the communities where we operate in both race/ethnicity and gender. |

| • | Strive to increase the representation of women and people of color in leadership positions. |

| • | Help ensure representation of women and people of color on the Board. |

| • | Work to strengthen the supply chain by expanding relationships and opportunities to purchase goods and services from minority- and women-owned businesses. |

| • | Work to ensure pay equity for comparable work, experience and performance, regardless of gender, race, religion or age, through third-party reviews and internal analysis. |

In 2022, we made strong progress on our DEI goals, including launching a pay equity assessment, initiating DEI training and establishing a Supplier Diversity Program. For more information on our DEI programs, see our 2022 Sustainability Report.

Information as of December 31, 2022. (1) U.S. and Canada (2) U.S. |

Across our 50-year history, one thing that has remained consistent is our dedication to creating innovative, longer-lasting, more sustainable building products for our customers. We are committed to producing products that are both responsibly sourced and known for exceeding the performance expectations of our customers. We create high-quality and durable products by focusing on three areas: product quality and safety, responsible sourcing and product innovation.

We work with third parties to develop lifecycle assessments (LCA) and environmental product declarations (EPD) for LP products. The LCAs and EPDs allow us to assess and compare the environmental impact of our products’ lifecycle in line with internationally recognized standards, including International Organization for Standardization (ISO) standards. We believe EPDs are a valuable tool for comparing products and providing transparency into the environmental footprint of a product across its full manufacturing value chain, from raw materials to product end-of-life.

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 18

An important part of our commitment to Do the Right Thing Always is protecting our planet. Our Policy on Environmental Stewardship, which may be viewed at www.lpcorp.com/about-lp/sustainability/the-environment, outlines our commitments and is supported by innovative programs and processes.

CLIMATE CHANGE

We believe we have a role to play in mitigating the impacts of climate change—both through our innovative products and by limiting the potential environmental impacts of our operations. As detailed in our 2022 Sustainability Report and TCFD index, we strive to incorporate climate change considerations into the way we do business, from product development to product end-of-life.

Our Policy on Environmental Stewardship details our broader commitment to reducing emissions, waste and water use, and conserving the environment in and around our operations.

SUSTAINABLE SOURCING

We believe that one of the greatest environmental opportunities we have at LP is to ensure that the forest resources we rely on are managed sustainably to meet the needs of future generations. Our fiber sourcing and forest management processes are certified to the Sustainable Forestry Initiative® (SFI®) and Programme for the Endorsement of Forest Certification (PEFC®) standards. All the wood used in our products is sourced in compliance with our Commitment to Sustainable Forestry and our SFI® and PEFC® standards. This helps assure LP and our customers that these forestlands are being managed responsibly and are achieving the environmental standards we demand.

We work to protect and maintain biodiversity in and near our operations, primarily by conducting biodiversity assessments before we begin operating to understand and mitigate potential biodiversity risks. Our forest management process helps preserve a range of age classes and forest types to protect habitats for plant and animal species that require younger as well as older forests to thrive.

LP received the SFI® President’s Award in 2022, recognizing our sustainable forestry leadership.

MANUFACTURING EFFICIENCY

Our manufacturing systems are intended to limit our environmental impact. All LP manufacturing facilities use site-specific environmental management programs to help reduce waste and promote clean air and water quality when producing engineered wood building products. To further promote sustainability and limit non-GHG air emissions in our manufacturing processes, we strive to source technology that helps save energy and reduce waste. One example of this technology in action is the emissions control systems we have in place across our operations. These systems capture 99.9% of the particulate matter produced from biomass combustion and pressing wood and resins under high heat before it leaves our emissions stacks. The particulate matter captured is then used in the manufacturing process or for energy recovery. In turn, this allows us to achieve or exceed air quality regulatory standards and mitigate our air emissions. We maintain additional control systems at our facilities that allow us to track, capture and destroy non-GHG air emissions to prevent them from entering the atmosphere. We aim to continue to evaluate our operations for opportunities to reduce emissions and maximize efficiency—whether by designing new systems, upgrading systems or identifying small changes that can have a big impact.

QUANTIFYING OUR CARBON FOOTPRINT

Understanding our emissions is critical for developing and guiding our decarbonization efforts. Our Scope 1 and 2 greenhouse gas (GHG) emissions arise primarily from the natural gas and electricity used in our operations. However, a significant amount of our energy is derived from the use of residual biomass resulting from our manufacturing process.

In addition to evaluating our Scope 1 and 2 GHG emissions, in 2021 we measured and disclosed our 2019 Scope 3 GHG emissions inventory reflective of normal (pre-COVID-19) operations. This evaluation was an important step in understanding emissions across our supply chain.

We give back to local communities through product and monetary donations and through the LP Foundation, our separate, LP-funded 501(c)(3) nonprofit. We also give LP employees the opportunity to donate their funds, time and skills to better their communities, whether through LP-sponsored volunteer events or through our charitable giving employee match program. We focus on promoting diversity in our charitable giving programs. In 2022, we expanded DEI giving to align with our DEI commitments both within and outside of LP.

Our Human Rights Policy, Code of Business Conduct and Ethics and Policy for Respecting the Rights of Indigenous Peoples detail our commitments to respecting and collaborating with Indigenous communities across the areas where we operate. We work with Indigenous nations to promote economic growth, provide education and employment and support community infrastructure projects.

More information about our environmental, social and governance program is available in LP’s 2022 Sustainability Report located at www.lpcorp.com/sustainability. Our 2022 Sustainability Report and other information contained on the website are not incorporated by reference herein.

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 19

LP’s Insider Trading Policy prohibits LP’s directors, executive officers, and certain employees at LP from engaging in short-term, hedging or speculative transactions involving LP Common Stock. LP maintains this policy because such transactions, which might be considered short-term bets on the movements of LP Common Stock, could create the appearance that the person is trading on insider information. In addition, hedging transactions may permit a director, executive officer, or manager of LP to continue to own securities of LP obtained through employee benefit plans or otherwise but without the full risks and rewards of ownership. When that occurs, the person may no longer have the same objectives as LP’s other shareholders.stockholders.

Under LP’s Insider Trading Policy, the following hedging and monetization transactions with respect to LP securities are prohibited:prohibited unless otherwise approved in writing by LP’s General Counsel:

| • | engaging in “short sales”; |

| • | buying and selling options (“put” or “call”); |

| • | ||

| prepaid variable forwards; |

| • | equity swaps; |

| • | collars; and |

| • | exchange funds. |

The Board Leadership StructureWhile not prohibited, under the Insider Trading Policy, LP discourages insiders from placing standing or limit orders on LP securities.

LP’s Insider Trading Policy also prohibits the pledging of LP securities unless otherwise approved in writing, including pledges of LP securities as collateral for margin and other loans.

The membersBoard’s committees and membership on each committee as of March 1, 2023 are set forth in the table below. Each committee shown below has a written charter delineating its membership, duties and functions. Copies of the Board have a diverse set of skillscurrent committee charters are available on LP’s website, www.lpcorp.com, by clicking on “About LP,” then “Financial Info,” then “Investor Relations,” and experiencesthen “Corporate Governance” and all of the members, except our CEO, are independent. While our Board’smay also be obtained by writing to Corporate Governance Principles provide flexibility in who may serve as Chairman of the Board, the Board currently maintains a separate Chairman position to enhance the Board’s independence and effectiveness. The Board has full access to the experience and insight of the CEO, as he is a member of the Board.Affairs, Louisiana-Pacific Corporation, 1610 West End Avenue, Suite 200, Nashville, Tennessee 37203.

| Name of Director | Audit | Compensation | Governance | Executive |

| Jose A. Bayardo |  |  | ||

| Tracy A. Embree |  |  | ||

| Lizanne C. Gottung |  |  |  | |

| F. Nicholas Grasberger III |  |  |  | |

| Ozey K. Horton, Jr. |  |  | ||

| Stephen E. Macadam |  |  |  |  |

| Dustan E. McCoy |  |  |  | |

| W. Bradley Southern |  | |||

| 2022 Meetings | 4 | 4 | 4 | 0 |

The Chairman’s current duties include: preparing agendas for Board meetings in consultation with other directors and management; chairing meetings of the Board and executive sessions of the independent directors; chairing meetings of the Executive Committee; leading the independent directors in periodic reviews of the performance of the CEO; keeping directors informed by timely distribution of information; serving as liaison between independent directors and the CEO; and recommending independent outside advisors who report directly to the Board on material issues.

Oversight of Risk

The directors are elected representatives of the stockholders and act as fiduciaries on their behalf. In performing its general oversight function, the Board reviews and assesses LP’s strategic and business planning as well as management’s approach to addressing significant risks. All committees report directly to the Board regularly, and all committee minutes are distributed for review by the entire Board. Additionally, the Board and committees are authorized to retain independent advisers, including attorneys or other consultants, to assist in their oversight activities.

As set out in LP’s Corporate Governance Principles, it is the responsibility of the CEO, and of executive management under the CEO’s direction, to:

LOUISIANA-PACIFIC CORPORATION•2020 PROXY STATEMENT 15

The Board fulfills its oversight responsibilities as set out in the Corporate Governance Principles on behalf of the stockholders and in furtherance of LP’s long-term health. The Board’s role does not involve managing the daily complexities of business transactions. The current leadership structure provides directors with significant information related to risks faced by LP, as well as an opportunity to synthesize, discuss and consider these risks independent of management and to provide guidance to management.

As part of its oversight responsibilities, the Board and its committees are involved in the oversight of risk management of LP. It does so in part through its review of findings and recommendations by LP’s Risk Management Council, the participants of which are executives and/or functional department leaders in the areas of risk management, finance, internal audit, legal and compliance, information technology (including cyber-security), environmental, and product quality, all of whom supervise day-to-day risk management throughout LP. The purpose of the Risk Management Council is to help the CEO assess the effectiveness of LP’s identification and handling of risks. The Board and its committees have direct access to financial and compliance leaders on a quarterly basis or more frequently if requested. Further, the Board is provided a comprehensive report as to the Council’s risk mapping efforts, as well as management’s efforts to mitigate and transfer risk.

The Board committees consider risks within their areas of responsibilities under each of their charters. The Audit = Committee

= Committee is responsible for the following risk oversight functions:

The Governance Committee is responsible for oversight of risk related to various regulatory changes and trends related to corporate governance, including Board member selection and maintaining appropriate corporate governance principles and guidelines, as well as overseeing annual evaluations to assess Board and committee effectiveness. = Chair

= Chair

The EQC Committee is responsible for oversight of risk related to (i) quarterly written reports it receives from functional leaders responsible for compliance, including LP’s Senior Vice President of Manufacturing Services, the Director of Internal Audit and the Director of Compliance and (ii) various allegations made through the anonymous hotline.

The Compensation Committee is responsible for oversight of risk relating to employment policies and LP’s compensation and benefits systems and annually reviewing these policies and practices to determine whether they are reasonably likely to have a material adverse effect on LP.

During 2019,2022, each director attended at least 75% of the total number of meetings of the Board and meetings held by all committees of the Board on which he or she served during his or her tenure on the Board or such committees. The Board held six meetings in 2019. While LP does not have a policy regarding attendance by directors at LP’s annual meetings of stockholders, all directors serving on the Board at that time attended the 2019 Annual Meeting of Stockholders.

The Board’s committees and membership on each committee as of April 7, 2020 are set forth in the table below. Each committee shown below other than the Executive Committee has a written charter delineating its membership, duties and functions. Copies of the charters are available on LP’s website by clicking on “About LP,” then “Investor Relations,” and then “Corporate Governance” and may also be obtained by writing to the address listed above.

| Name of Director | Audit | Compensation | Corporate Governance | EQC | Executive |

| E. Gary Cook |  |  |  | ||

| Tracy A. Embree |  |  | |||

| Lizanne C. Gottung |  |  | |||

| F. Nicholas Grasberger III |  |  | |||

| Ozey K. Horton, Jr. |  |  | |||

| Kurt M. Landgraf |  |  |  | ||

| Stephen E. Macadam |  |  | |||

| Dustan E. McCoy |  |  | |||

| W. Bradley Southern |  |  | |||

| 2019 Meetings | 5 | 4 | 3 | 4 | 0 |

|  |

LOUISIANA-PACIFIC CORPORATION•2020 2023 PROXY STATEMENT 1620

The Audit Committee is responsible for:

| • | assisting the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of LP (including LP’s financial statements); |

| • | LP’s compliance with legal and regulatory reporting requirements; |

| • | oversight of LP’s enterprise risk management program and certain other risks, as described under the heading |

| • | receiving and reviewing regular reports regarding issues such as: |

| the status and findings of internal audits and audits being conducted by LP’s independent registered public accounting firm, |

| the status of material litigation, |

| significant accounting events, |

| accounting changes that could affect LP’s financial statements, and | ||

| — | proposed audit adjustments; |

| • | because of the importance of the integrity of our information technology systems to financial reporting, reviewing LP’s information technology platform and processes, as well as strategies, to prevent, detect and mitigate any cybersecurity threat; and |

| • | such other duties as directed by the Board. |

Additionally, the Audit Committee has sole authority for the appointment, compensation and oversight of LP’s independent registered public accounting firm, including the approval of any significant non-audit relationship. To satisfy its various oversight responsibilities, the Audit Committee meets regularly with LP’s CFO,Chief Financial Officer, Director of Internal Audit, LP’s independent registered public accounting firm and other members of management, as needed.

The Audit Committee charter requires that each member of the Audit Committee must meet the qualification and independence requirements of the listing standards adopted by the NYSE and the independence standards set forth in Rule 10A-3 underof the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has determined that each member of the Audit Committee has met such qualification and independence requirements.requirements and standards.

We also have, and will continue to have, at least one member of the Audit Committee who has past employment experience in finance or accounting and requisite professional certification in accounting or other comparable experience that results in the individual’s financial sophistication. The Board of Directors has determined that Mr. Grasberger, Mr. LandgrafMacadam and Mr. MacadamBayardo are audit committee financial experts (as such term is defined under applicable rules of the SEC).

The Compensation Committee is responsible for:

| • | assisting the Board in fulfilling its responsibility for oversight relating to the compensation of the executive officers of LP; |

| • | reviewing and approving the strategy and design of LP’s compensation and benefits systems; |

| • | making recommendations to the Board for incentive compensation and equity-based compensation plans, including specifically reviewing and making recommendations regarding the compensation of LP’s CEO and reviewing and approving salaries and incentive compensation of other executive officers; |

| • | administering LP’s equity and cash incentive compensation plans; |

| • | selecting and regularly reviewing the peer group used for benchmarking compensation for executive officers; and |

| • | oversight of certain risks related to LP’s employment practices and compensation as described under the heading |

To assist it in satisfying these oversight responsibilities, theThe Compensation Committee has retained its own compensation consultant and meets regularly with management to understand the financial, human resources and shareholderstockholder implications of compensation decisions being made. In accordance with its written charter adopted by the Board, the Compensation Committee has oversight responsibility with respect to compensation policies designed to align compensation with our overall business strategy, values and management initiatives. In discharging its oversight responsibility, the Compensation Committee has retained its own independent compensation consultant, FW Cook, to advise the Compensation Committee regarding market and general compensation trends, assist in determining the appropriate executive officer compensation in 2022 and advise the Compensation Committee about its executive compensation programs and policies. At the Compensation Committee’s request, FW Cook attends committee meetings and meets with individual committee members to plan for committee meetings. The Compensation Committee chair also regularly meets between formal Compensation Committee meetings with management and the Compensation Committee’s consultant.consultant between formal Compensation Committee meetings. In 2022, the Compensation Committee generally sought input from FW Cook on a range of factors related to LP’s compensation programs, including comparative peer company data, competitive positioning of executive pay, plan design, long-term incentive pay practices, and market trends.

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 21

FW Cook is responsible solely to the Compensation Committee, with the exception of its services to the Governance Committee regarding director compensation, and undertook no work with the management of LP without approval from the Compensation Committee chair. The Compensation Committee has affirmed the independence of FW Cook through a review of the firm’s independence policy and other relevant matters, and is not aware of any conflict of interest that would prevent the consultant from providing independent advice to the Compensation Committee regarding executive compensation matters. FW Cook has had no other business relationship with LP and has received no payments from us other than fees for services to the Compensation Committee and the Governance Committee. FW Cook is not the beneficial owner of any shares of LP Common Stock, and fees payable by LP to FW Cook during 2022 were less than 1% of the firm’s gross revenues.

LP’s Chief Executive Officer makes recommendations to, and participates in the deliberations with, the Compensation Committee regarding the amount and form of the compensation of the other executive officers, but does not participate in the determination of his own compensation or the compensation of directors.

The Compensation Committee charter requires that each member of the Compensation Committee must qualify as an “independent director” under the listing standards adopted by the NYSE. The Board has determined that each member of the Compensation Committee has met such independence requirements.

LOUISIANA-PACIFIC CORPORATION•2020 PROXY STATEMENT 17

Environmental, Quality and Compliance Committee

The EQC Committee is responsible for the following:

Additionally, LP’s Senior Vice President of Manufacturing Services, the Director of Internal Audit and the Director of Compliance report in person annually to the EQC Committee on a rotating basis and are generally available for other committee meetings, as needed. The Director of Compliance is a regular participant in EQC Committee meetings.

NominatingGovernance and Corporate GovernanceResponsibility Committee

The Governance Committee is responsible for:for, among other things:

| • |

| • | determining criteria for selecting and evaluating potential nominees for | |

| director, including skills and diversity that would be advantageous to add to the Board, identifying persons qualified to become directors and recommending |

| • | if appropriate, in the sole discretion of the Governance Committee, retaining a search firm to identify potential candidates for the Board and approving such firm’s fees and other retention terms; |

| • | considering and making recommendations to the Board regarding the |

| • | developing, and recommending for consideration by the Board, |

| • |

| • | managing the CEO selection and evaluation process used by the Board and reviewing management succession processes; |

| • | providing oversight and direction on LP’s |

| • | reviewing the implementation of |

| • | reviewing and implementing LP product quality policies and standards, including claims and quality incident reports; |

| • | oversight of LP’s (i) programs for ethics and business conduct, including reviewing matters raised through LP’s confidential hotline reporting service, and (ii) political activities and advocacy, including political fundraising and contributions; |

| • | reviewing, at least annually, LP’s ethics and business conduct practices, trends and issues, and reporting to the Board |

| • | providing oversight of LP’s compliance with federal and state laws, regulations and rules; |

| • | providing oversight and policy direction on diversity and employee satisfaction; and |

| • | oversight of certain risks related to corporate governance as described under the heading | |

In 2022, the Governance Committee sought input from FW Cook related to director compensation, including competitive positioning of director pay.

The Governance Committee charter requires that each member of the Governance Committee must qualify asbe an “independent director” under the listing standards adopted by the NYSE.independent director. The Board has determined that each member of the Governance Committee has met suchthe independence requirements.requirements of the listing standards adopted by the NYSE.

The Board has adopted stock ownership guidelines for directors as part of LP’s Corporate Governance Guidelines, which specify target amounts of share ownership. Each outside director is expected to acquire and hold a number of shares equal in fair market value to five times the regular annual cash retainer for outside directors within five years of joining the Board. As of December 31, 2022, all of the directors met the guidelines.

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 22

The Board believes that all directors must possess a considerable amount of education and business management experience. The Board also believes that it is necessary for each of the Company’sLP’s directors to possess certain general qualities, while there are other skills and experiences that should be represented on the Board as a whole, but not necessarily by each individual director.

| General qualities for all directors: | Specific experiences, qualifications and backgrounds to be represented on the Board as a whole: | |||

| • | Extensive executive leadership experience | • | Financial and/or accounting expertise | |

| • | Excellent business judgment | • | Knowledge of international markets | |

| • | High level of integrity and ethics | • | Chief executive officer/chief operating officer/chief financial officer experience | |

| • | Original thinking | • | Extensive board experience | |

| • | Strong commitment to LP’s goal of maximizing stockholder value | • | Diversity of skill, background and viewpoint | |

Under LP’s Corporatethe Governance Principles,Committee charter, the Governance Committee is responsible for determining the criteria for membership on the Board. The Governance Committee uses the results of annual evaluations of the Board and Board committees in evaluating the skills and attributes desired in new director candidates. The Corporate Governance Principles and the Governance Committee set forth the following are criteria for membership on the Board:

LOUISIANA-PACIFIC CORPORATION•2020 PROXY STATEMENT 18

| • | directors must be persons of integrity, with significant accomplishments and recognized business stature, who will bring a diversity of perspectives to the Board; |

| • | one or more directors should have significant experience in the type of industry and business in which LP operates; |

| • | experience in some capacity with publicly traded companies is a desirable attribute; |

| • | although the Board has not adopted a specific policy with regard to considering diversity in identifying director nominees, the Corporate Governance Guidelines require the Governance Committee to take into account diversifying factors that it deems appropriate which include, among other things, diversity in professional and personal experience, skills, expertise, background, expertise, gender, race, ethnic background and cultural and geographical |

| • | directors must be able to commit the requisite time to prepare for and attend all regularly scheduled meetings of the Board and committees on which they serve, except when there are unavoidable business or personal conflicts. |

Additionally, the Governance Committee believes it to be desirable for all new outside directors (as is true of all current outside directors) to qualify as independent under the listing standards adopted by the NYSE and applicable SEC rules. The Corporate Governance PrinciplesGuidelines recognize that LP’s CEO will normally be a director and that other senior officers may be elected to the Board in appropriate circumstances, as long as a majority of directors are independent as determined by the Board in accordance with the listing standards adopted by the NYSE.NYSE and applicable SEC rules.

As part of its annual self-assessment process, the Board and its committees determine the specific skill sets and necessary characteristics for an effective committee and the Board as a whole. If the Board, generally or through the Governance Committee, determines that a necessary skill set or perspective is absent, the Board will authorize an increase in the number of Board members.

In the event of a vacancy on the Board, the Governance Committee determines which skills should be sought in filling the vacancy and then each current director is asked to suggest names of potential director candidates based on the applicable criteria. The Governance Committee is also authorized by its charter to retain a third-party search firm to assist in identifying director candidates. As part of its search process for potential candidates for director, the Governance Committee considers a potential candidate’s ability to contribute to the diversity of personal and professional experiences, opinions, perspectives and backgrounds on the Board. After potential candidates are identified, the Governance Committee designates one or more directors to screen each potential candidate. Following that screening process, the Governance Committee (or a subcommittee) conducts in-person or telephone interviews with candidates warranting further consideration, and based on the results of those interviews, the Governance Committee recommends a candidate to the full Board for election, as well as alternative candidates whom the Board may wish to consider.

The Governance Committee will consider stockholders’ recommendations concerning nominees for director. Any such recommendation, including the name and qualifications of a nominee, may be submitted to LP at its corporate offices: Louisiana-Pacific Corporation, 414 Union Street,1610 West End Avenue, Suite 2000,200, Nashville, Tennessee 37219,37203, to the attention of the ChairmanChair of the Governance Committee. Stockholder-recommended candidates will be evaluated using the same qualities and criteria described above.

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 23

LP’s Bylaws provide that nominations for election to the Board may be made by the Board or by any stockholder of record entitled to vote for the election of directors. The number of nominees a stockholder may nominate for election at a stockholder meeting may not exceed the number of directors to be elected at such meeting. Notice of a stockholder’s intent to make such a nomination must be given in writing by personal delivery or certified mail, postage prepaid, to the Corporate Secretary of LP, and generally must include the following:

| • | The name and address of such stockholder and each proposed nominee; |

| • | The class, series and number of shares of LP beneficially owned or owned of record by such |

| • | A representation (i) that the stockholder is a record holder of Common Stock entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice and (ii) as to whether the stockholder intends to deliver a proxy statement and form of proxy to holders of at least the percentage of shares of LP entitled to vote and required to approve the nomination and, if so, identifying such stockholder; |

| • | A complete and accurate description of (i) any |

| • | Any proxy, contract, arrangement, understanding or relationship pursuant to which such stockholder or any proposed nominee has a right to vote any shares of LP or which has the effect of increasing or decreasing the voting power of such stockholder; |

| • | Any rights directly or indirectly held of record or beneficially by such stockholder or any proposed nominee to dividends on the shares of LP that are separated or separable from the underlying shares of LP; |

LOUISIANA-PACIFIC CORPORATION•2020 PROXY STATEMENT 19

| • | Any performance-related fees (other than an asset-based fee) to which such stockholder or any proposed nominee may be entitled as a result of any increase or decrease in the value of shares of LP or Derivative Interests; |

| • | A description of any arrangements or understandings pursuant to which the nominations are to be made; |

| • | Any other information relating to such stockholder or a proposed nominee that would be required to be disclosed in a proxy statement or other filing required pursuant to Section |

| • |

| • | Information regarding securities of such stockholder (or other nominating person) owned by any proposed nominee; |

| • | A completed written questionnaire with respect to the identity, background and qualification of the proposed nominee and the background of any other person or entity on whose behalf the nomination is being made; |

| • | A written representation and agreement (in the form provided by the Corporate Secretary upon written request) that (i) the proposed nominee |

LOUISIANA-PACIFIC CORPORATION• 2023 PROXY STATEMENT 24

| trading policies and all other guidelines and policies of | ||

| • | A representation from such stockholder as to whether such stockholder or other person making the nomination intends or is part of a group that intends to (i) solicit proxies or votes in support of the election of any proposed nominees in accordance with Rule 14a-19 under the Exchange Act or (ii) engage in a solicitation (within the meaning of Rule 14a-1(1) under the Exchange Act) with respect to the nomination or other business, as applicable, and if |

| • | An acknowledgement that, if such stockholder (or a qualified representative of the stockholder) does not appear in person or by proxy at the meeting to present such proposed nominee at such meeting, LP need not present such proposed nominee for a vote at such meeting notwithstanding that the nomination is set forth in the notice of the meeting or other proxy materials and notwithstanding that proxies or votes in respect of the election of such proposed nominee may have been received by LP (which proxies and votes shall be disregarded). |